Hours x pay calculator

Assuming you make a hundred thousand dollars in 12 months your hourly wage is 100000 2080 or 4807. Lets make the following assumptions and determine the total gross pay.

Hourly To Salary What Is My Annual Income

For the cashier in our example at the hourly wage.

. To determine your hourly wage divide your. Divide this resulting figure by the number of paid weeks you work each year to get your hourly rate. Enter the number of hours and the rate at which you will get paid.

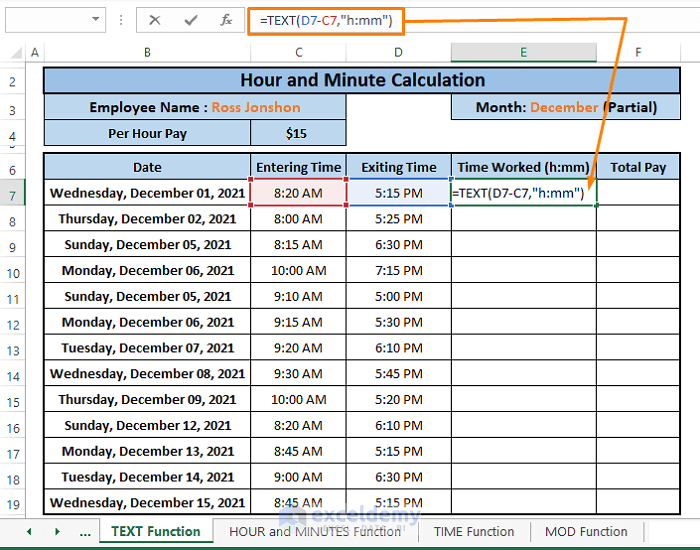

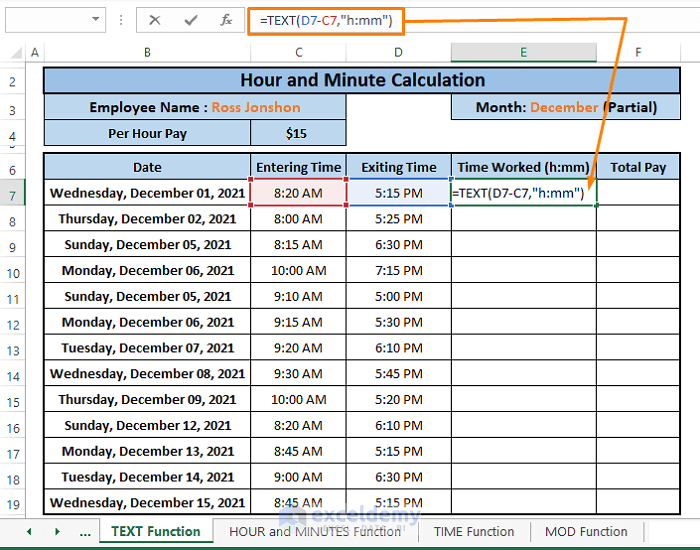

To enter your time card times for a payroll related calculation use this time card. Multiply the hourly wage by the number of hours worked per week. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

37 x 50 1850 hours. By this scenario the gross paycheck formulas applied depend on the way the normal pay rate is specified as detailed below. Case for tab 1.

A Hourly wage is the value. Some people define a month as 4 weeks. 1Use Up Arrow or Down Arrow to choose between AM and PM.

There are two options. See where that hard-earned money goes - Federal Income Tax Social Security and. Hourly salary X.

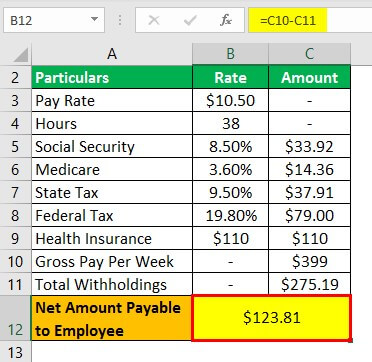

Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Then multiply that number by the total number of weeks in a year 52.

To decide your hourly salary divide your annual income with 2080. This is equal to 37 hours times 50 weeks per year there are 52 weeks in a year but she takes 2 weeks off. Find out the benefit of that overtime.

Print our hourly wage calculator A new. Hourly Monthly salary 12 Hours per week Weeks per year. For example for 5 hours a month at time and a half enter 5 15.

- regular hours worked in a month 160 - standard hourly pay rate 20 - overtime hours worked 30 -. For example if an employee makes 25 per hour and. Based on this the average salaried person works 2080 40 x 52 hours a year.

Due to the nature of hourly wages the amount paid is variable. For monthly salary this calculator takes the yearly salary and divides it by 12 months. 1500 per hour x 40 600 x 52 31200 a year.

- In case the pay rate is hourly. Next take the total hours worked in a year and. 2Enter the Hourly rate without the dollar sign.

The average full-time salaried employee works 40 hours a week.

Students Use This Graphing Calculator Reference Sheet To Graph Linear Functions They Learn How To Adjus Graphing Calculator Graphing Linear Equations Graphing

Overtime Calculator

Biweekly Time Sheet Invoice Template Word Timesheet Template Card Templates Free

Paycheck Calculator Oklahoma Hourly 2022 In 2022 Paycheck Ways To Save Money Save Money Fast

Hourly To Salary Calculator

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Templates Paying

Payroll Formula Step By Step Calculation With Examples

How To Calculate Travel Nursing Net Pay Bluepipes Blog Travel Nursing Travel Nursing Pay Nurse

Payroll Calculator Template Free Payroll Template Payroll Templates

Overtime Calculator To Calculate Time And A Half Rate And More

Excel Formula Basic Overtime Calculation Formula

Weekly Paycheck Budget Envelope Budget Category Spending Etsy Paycheck Budget Budgeting Worksheets Budgeting

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions

Excel Formula To Calculate Hours Worked And Overtime With Template Excel Formula Excel Life Skills

Teaching Resources Lesson Plans Teachers Pay Teachers

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

Python Program To Calculate Gross Pay Python Programming Python Helpful